Let’s face it – the cost of living isn’t getting any easier, especially for busy families trying to juggle everything from food shops to family days out. But Gemma Bird, a financial expert who is a Sunday Times Bestselling Author and regular on ITV Lorraine's Saver Squad , is here to show us that with a few clever tweaks, saving money doesn’t have to mean sacrificing quality. From sneaky supermarket tricks to making the most of loyalty schemes, these tips are all about making your money go further without feeling like you're missing out. Ready to get savvy?

Don’t Just Look at the Price, Look at the Price Per 100g

Don’t be fooled by flashy “offers.” That family-sized box might look like a bargain, but the price-per-100g (or ml) on the shelf label tells the truth. Compare those before you throw it in the trolley, you might find the smaller or own-brand version gives you more for less.

Loyalty Cards & Cashback = Free Money

If a shop’s offering a loyalty card, grab it. Tesco Clubcard, Lidl Plus, Nectar, Boots Advantage... they’re free and can save you a fortune. You get discounts, surprise vouchers and the odd freebie. I once saved a fiver on Bronte’s nappies with a Boots voucher, it all adds up!

Before I check out online, I always pop onto a cashback site like Quidco. We've earned money back on everything from broadband to takeaways. It’s basically free cash for clicking one extra button.

And never just auto-renew your insurance! Whether it's a car, home, or even the dog's cover, Compare the Market has saved us loads. Plus, the Meerkat perks? Obsessed!

Affordable Doesn’t Mean Low Quality

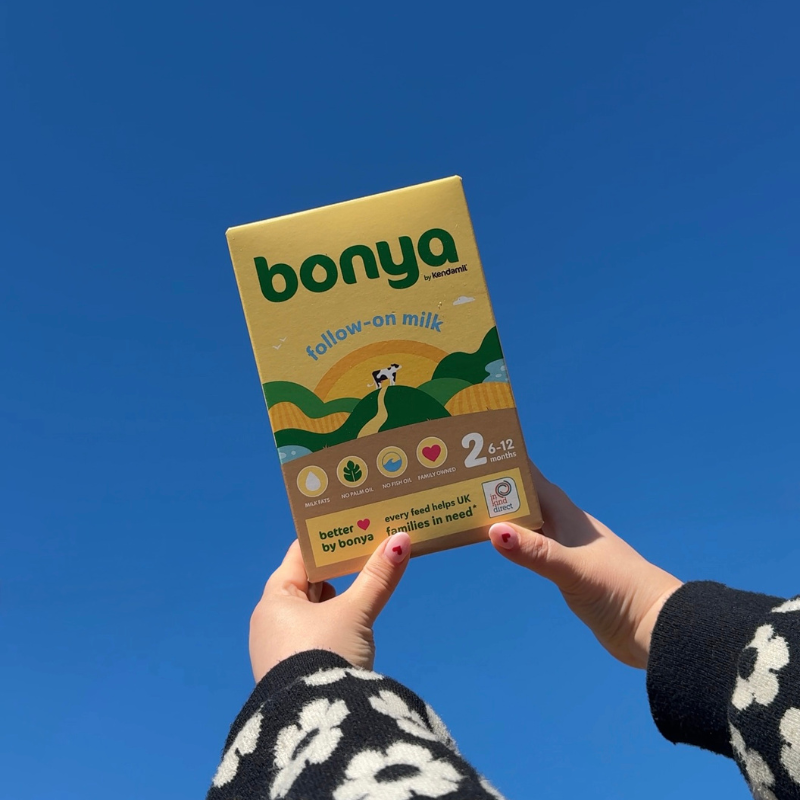

A big price tag and shiny branding doesn’t guarantee better quality, especially with baby products. Affordable brands like Bonya offer high-quality, safe formula without the inflated cost. Challenge the myth. Budget buys can be brilliant, let's bin the stigma!

Make the Most of £1 Kids’ Meals and Use Trusted Charities & Support Hubs

Loads of places do kids meals for £1 or less; Asda, Morrisons, Hungry Horse and more, especially in the school holidays. We often plan days out around the deals, it saves loads!

Charities like In Kind Direct help families get essentials through trusted local groups, and Bonya’s Formula Fog Hub (coming soon!) will be a safe space for honest, no-judgement parent advice. Remember, asking for support isn’t weakness, it’s smart.

I’m also always checking Facebook Marketplace for bargains or selling things we no longer need, it’s great for the kids' bits!

Use a ‘No-Spend Day’ to Reset the Budget Each Week

This is a little tradition we’ve started at home, usually on a Wednesday. No spending, no top-ups, no online orders. We turn it into a bit of a family challenge: what can we cook from the freezer? What games can we play without spending a penny? Adam gets competitive (obviously), and Brody just loves helping stir stuff! One no-spend day a week can save £30-£50 a month easily.

Small changes can make a big difference, and Gemma’s tips prove that budgeting isn’t about cutting back – it’s about getting smart. Whether it’s comparing prices properly, making the most of cashback, or embracing no-spend days, there are so many ways to take control of your finances without the stress. So why not try one or two this week and see how much you save? Your future self (and your bank balance) will thank you.